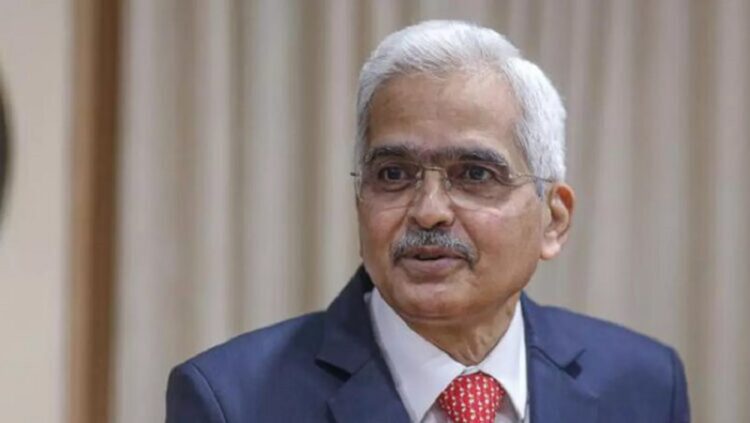

New Delhi: Reserve Bank of India Governor Shaktikanta Das has unveiled the bimonthly monetary policy for the fiscal year 2023-2024. “After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, the RBI’s Monetary Policy Committee decided unanimously to keep the policy repo rate unchanged at 6.5%,” Das said.

Despite the country experiencing rising inflation, the repo rate remains unchanged due to the economic development perspective. This decision was communicated by B. Shaktikant Das, the Governor of the Reserve Bank of India, who indicated that it was the decision of the Monetary Policy Committee (MPC). Das made this announcement following a meeting with the Monetary Policy Committee, which took place from October 4th to 6th.

He added that retail inflation is projected at 5.4% for 2023–24, with the second quarter at 6.4%, Q3 at 5.6%, and Q4 at 5.2%. “The risks are evenly balanced,” the governor pointed out. Between May 2022 and February 2023, the RBI implemented consecutive changes in the repo rate. However, it has now remained steady at 6.50% for the fourth consecutive time.

Comments