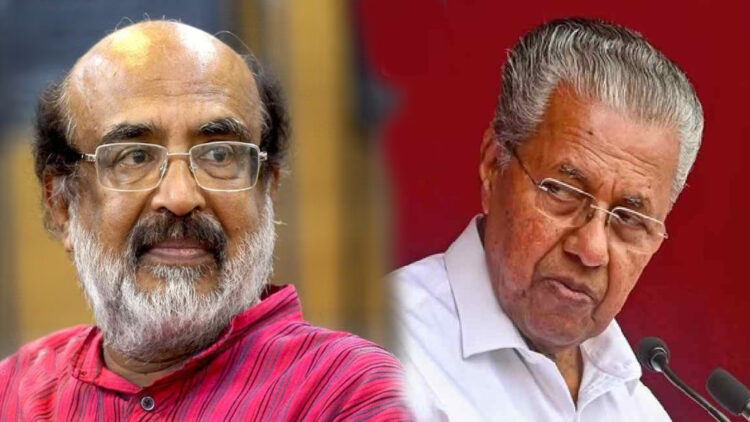

Thiruvananthapuram: Former Finance Minister Dr. Thomas Isaac has responded to the Enforcement Directorate (ED), asserting that he cannot be held solely accountable for the decision on ‘Masala Bonds’ by the Kerala Infrastructure Investment Fund Board (KIIFB). Isaac clarified in his reply that the board of directors, chaired by the Chief Minister, collectively made the decision, and as the finance minister, he served as the vice chairman.

In his defence, Isaac emphasised his ex-officio membership on the 17-member board of directors overseeing KIIFB Masala Bond matters, stating that he holds no special responsibilities and that all decisions are taken collectively by the board.

The ED had issued a notice to Thomas Issac, a prominent leader of the Communist Party of India (Marxist), to provide testimony regarding the utilisation of funds received through the KIIFB Masala Bond. However, the former Finance Minister was not present and submitted his reply later, outlining his perspective on the matter.

KIIFB Masala Bond case

The Kerala Infrastructure Investment Fund Board (KIIFB), established under the Kerala Infrastructure Investment Fund Act, is under scrutiny following the issuance of Masala Bonds on May 17, 2019, through the London Stock Exchange. The bonds, raising Rs 2,150 crores at an interest rate of 7.23 percent, have come into the spotlight after the Comptroller and Auditor General (CAG) identified irregularities, leading to an Enforcement Directorate (ED) investigation.

The controversy has escalated as the ED registered a case, invoking Section 13 of the Foreign Exchange Management Act (FEMA) of 1999. This section enables penalties up to three times the amount involved in the contravention, along with the confiscation of an equivalent value. The potential maximum fine in this case stands at Rs 6,450 crore.

States have no authority to borrow funds internationally. Loans can only be sourced domestically by giving consolidated funds as security. The state should make a law for this. The CAG contends that foreign loans, as facilitated through a corporate entity like KIIFB, contravene existing regulations.

Comments